Facebook might not appear to be the social media channel that advisers turn first to support their business development efforts. Professional and financial service providers generally are a little ‘snooty’ about the platform.

Here are some tips on how to make the most from your Facebook Business Page.

A new Facebook business page needs to be compliance checked and renewed annually

The compliance team will need to approve any newly-created business page and issue re-approval on an annual basis.

Complete the page information as fully as possible

Take the time to provide all of the information that is requested where possible. I see established Facebook pages that have provided scant information about the practice. This is an outward sign of a lack of commitment to the platform and is missing easy opportunities to help your profile online.

Use the check-in feature each time you post.

This is a location tag option you select for each post and is particularly helpful when a practice wants to anchor itself to a particular location.

Understand that you are communicating to people who are away from work

Unlike LinkedIn, Facebook is a more social channel. It’s an opportunity to inform people about personal finance solutions e.g. pensions and to communicate with a more human and less corporate voice. Make use of the Facebook tools like hash-tags and emojis. Facebook users will expect this. Long paragraphs of text conveys stuffiness and a lack of understanding about the platform.

Engagement is the key to success

Posts need to attract people’s attention. The ‘name of the game’ is getting people to engage. A cat up a tree I guarantee will get more likes than a post about using or losing your annual ISA allowance!

If you are involved in your community in any way (clubs, charities, rotary, education etc.) and can share details about what you do, these type of posts are great. They communicate something about the person and that provides other people with re-assurance.

Join community Facebook Groups

Community groups are good forums for people who ask for recommendations for service providers e.g. pensions. “Does anyone know a good pension adviser?” Being in these groups gives you a chance of responding directly or, even better, thanking someone who has provided your details in response to a request for a recommendation.

Grow your Facebook following

Try and increase the number of page followers every month.

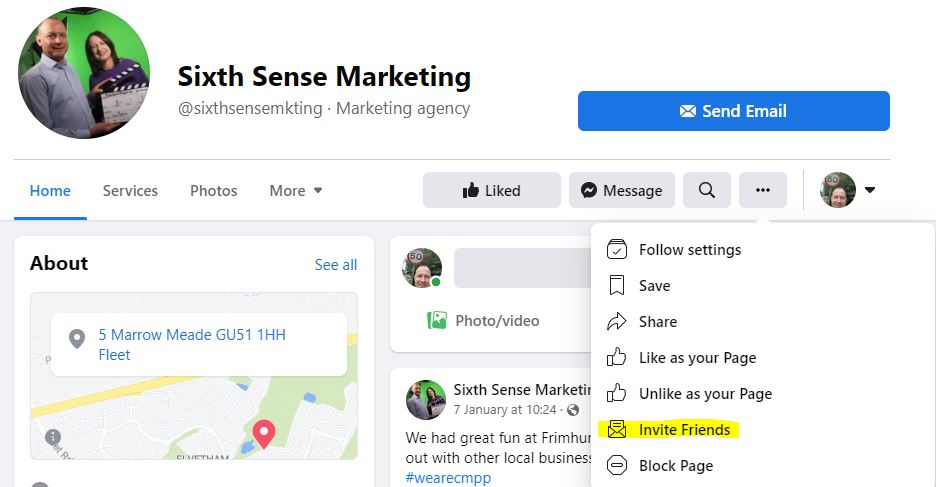

- Navigate to your Facebook Business Page, click the three little dots beside the search button then click “Invite Friends.” We have highlighted the relevant area from our own Facebook page.

- Contact clients individually and tell them you have opened up a new channel of communication and if they are on Facebook already they may want to follow you (and enclose a link to make it easy).

- Promote a post on Facebook to people in the same location as you. I prefer to create an advert that is about civic pride rather than anything to do with financial services. Then target people who are similar to your ideal client.

We are here to help

You may think that Facebook is becoming more important in helping promote your services. But you don’t have the time or inclination to manage the page yourself. Contact us and we can explain how we are looking after Facebook accounts and other social media channels for financial advisers.